- What is Internet Banking ?

-

Internet Banking is Banking services offered through a website for the registered customers of our Bank.

- What is the Internet Banking website of Central Bank of India ?

-

Internet Banking services are available through https://www.centralbank.net.in

- What are the Types of Internet Banking services available for MSME through the website ?

-

For Proprietorship concerns the facility of personal Internet banking is available. This facility is available in three options (View only, Tax payment only, full transactions rights) For all other Business relationships the facility of Corporate Internet banking is available. This facility is available in 3 modes (View only, Tax Payment only, full transaction rights)

- How are the 2 INB services different ?

-

The Personal internet Banking is operated by a single individual wherein all transactions are authenticated using his Transaction password and second factor of authentication (GRID /OTP / Digital Signature). The Corporate Internet Banking can be configured for use by multiple users configured under different roles such as maker, checker etc.

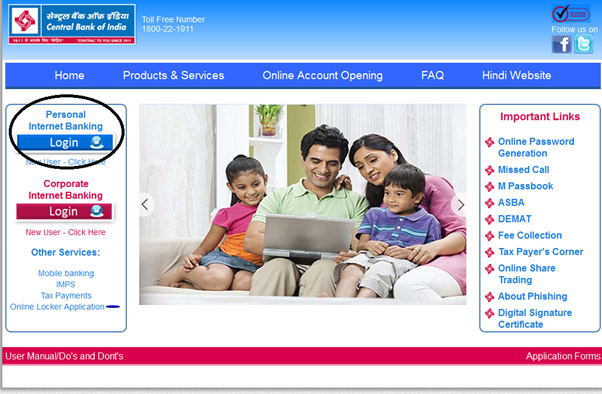

Retail customers can login to the Internet Banking website through the Personal Internet Banking link.

The transaction amount for the personal Users are as follows

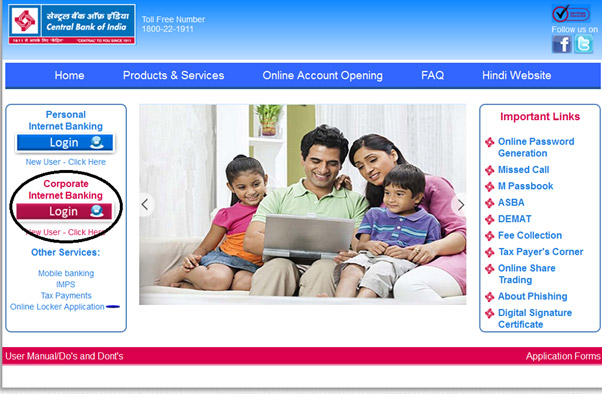

Corporate Internet Banking - Central Bank offers the net banking facility for the corporate customers also.

- How to register for this facility ?

-

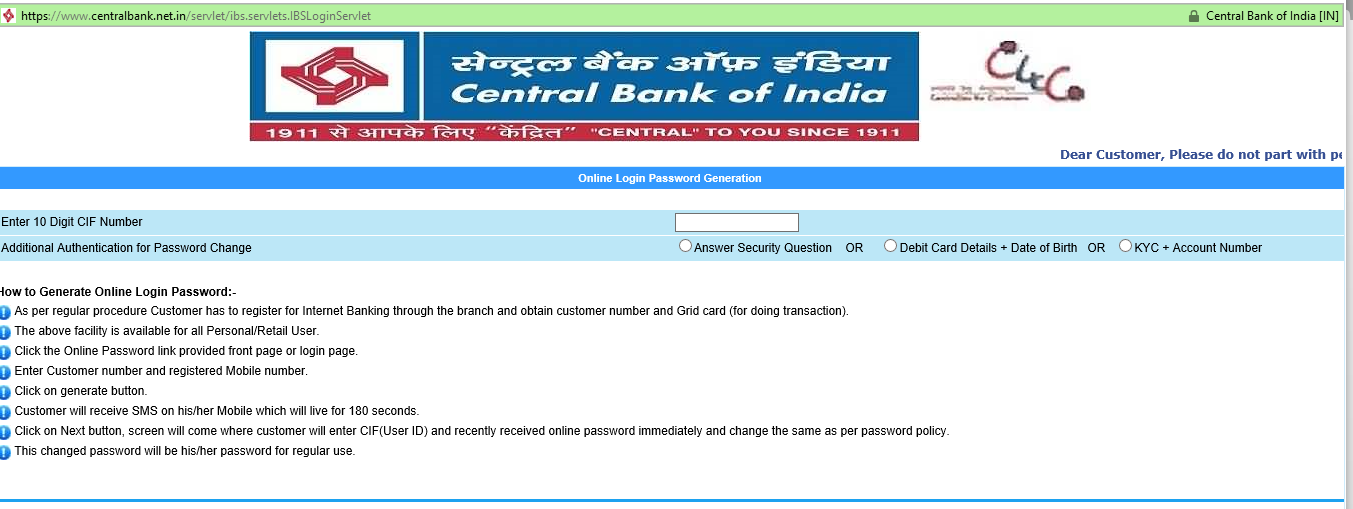

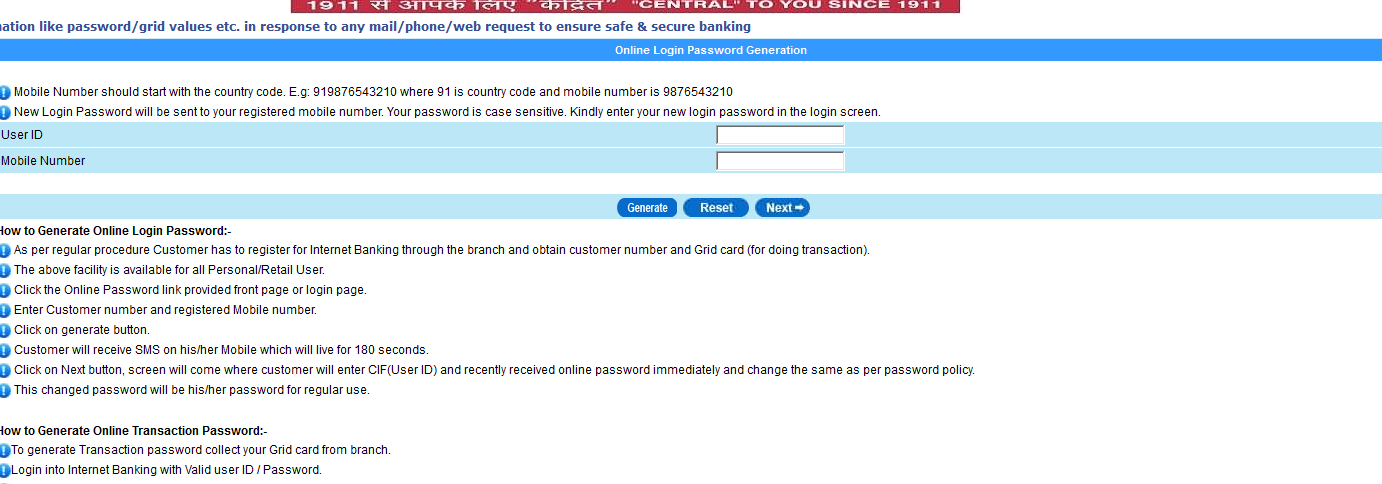

Presently the registration is available through the Branches only based on the application form. The Branch configures the facility for the customer and provide the user ID. After configuration of the facility the customer can generate password online and start using the facility. After configuration the customer can use the facility in self-service mode thereby reducing the dependency on the Branch.

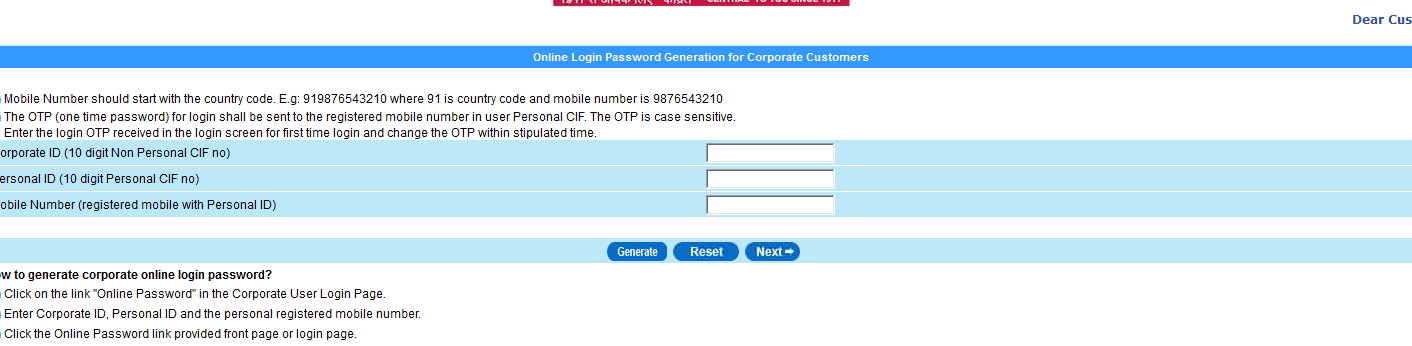

- Personal customers need to enter the user id(CIF) and registered mobile number

2. Corporate customers are required to enter the Corporate ID(Non personal CIF), personal CIF and the registered mobile number

- What are the facilities on Personal INB ?

-

The Internet Banking services are available in 11 Regional Languages in addition to English and Hindi. It has 45 services and more than 140 functionality which meets the needs of Retail and Corporate Customers. Some of the important services on personal Internet Banking are:

- Check account Balance and Download account statement. Facility to generate customised account statement is a special feature wherein the customer can select desired fields to be included in the generated account statement.

- Tax payments

- Online application of IPO

- Online Aadhar registration

- Online payment of credit cards

- Multi utility fee collection

- E-Filing of ITR returns

- Transaction profile setting

- Term deposit account modeling & opening

- DeMAT enquiry

- Fund Transfer: Own account, within Bank, Other Bank through NEFT/RTGS/IMPSl

- Hotlisting of ATM Cards

- Online Locker request

- Registration for PMJBY / PMSBY

- Registration for Atal pension yojna.

- PMNRF Donation

- Cheque book Request

- Stop Cheque request

- Donation

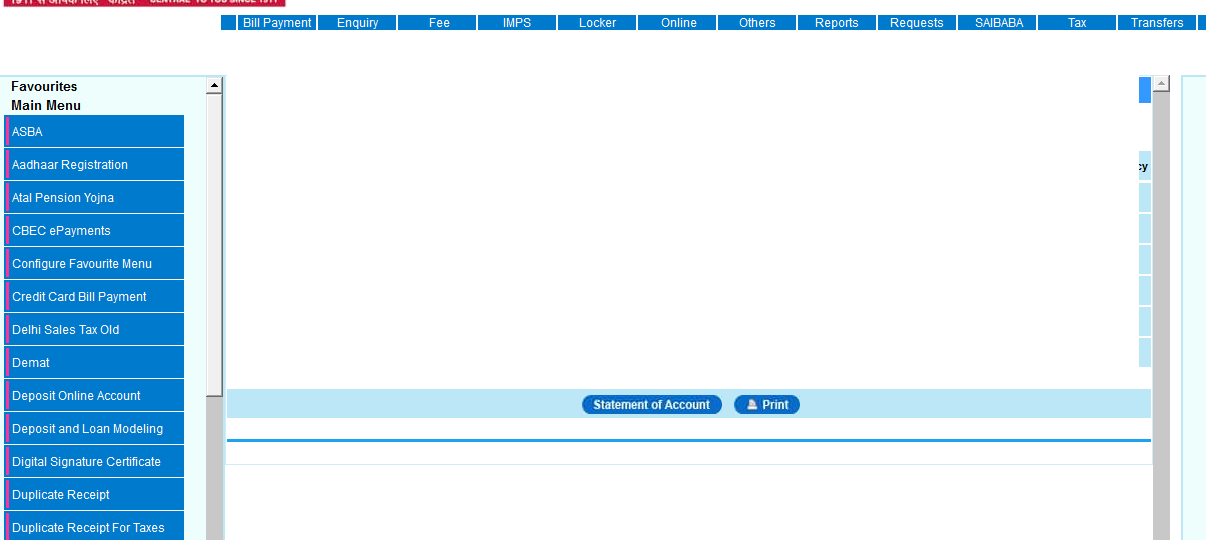

Corporate INB:

Some important features:

- Configurable as per the Customer’s Organizational design

- Fund transfer to own accounts and other CBI/Non-CBI accounts

- TAX / Utility Bill Payment like electricity, recharge etc.

- Beneficiary search option from large number of beneficiaries added

- Bulk Beneficiary creation/Bulk Beneficiary deletion

- Bulk file upload for other CBI and NEFT transactions

- Digital Signature as secured second factor authentication

- Check Balance and Account statement

- Pay EPF contribution for your organization

- Feature for Government Treasury to make payment through file upload

- Facility to generate customised account statement.

- How secure is the Internet Banking ?

-

The Internet Banking facility is hosted on servers which are kept in Bank’s Data center. The connection between customer computer and website is secured and encrypted. Any transaction is authenticated using at least 2 factors of authentication I,e User ID + Password and one of the chosen second factor (such as OTP / GRID Card / Digital Signature), at times on finding some change in customer usage pattern another authentication in form of security question may be asked by the system. Further any fund transfer outside Bank is possible only after beneficiary addition which becomes active after a cooling period of 4 hours. SMS alerts for all transactions are sent to the registered mobile number. The customer can convert accounts to view only in case of any issue.

- Can I use Internet Banking in foreign country / areas where receiving SMS is a challenge ?

-

Yes Internet Banking transactions can be authenticated using alternate options such as GRID / Digital Signatures.

- What are the minimum system requirement for accessing Internet Banking ?

-

The INB website can be accessed on any desktop or Laptop with browser such as Internet Explorer – 11, Chrome – 30 & above, Mozilla – 27 & above, Safari – 5 & above. There should be decent internet connection available on the desktop / laptop.

- How can I lock the facility ?

-

The INB facility is locked on three wrong attempts, hence customer can lock the facility himself and unlock it by generating online password.

Internet Banking Tab

FAQ